Don't be stupid enough to think these people running things now actually care about waste and fraud.

If they really did, they wouldn't be cutting IRS who actually increases revenue and goes after fraud.

https://www.propublica.org/article/h...p-musk-deficitUnlike with other federal agencies, cutting the IRS means the government collects less money and finds fewer tax abuses. Economic studies have shown that for every dollar spent by the IRS, the agency returns between $5 and $12, depending on how much income the taxpayer declared. A 2024 report by the nonpartisan Government Accountability Office found that the IRS found savings of $13,000 for every additional hour spent auditing the tax returns of very wealthy taxpayers — a return on investment that “would leave Wall Street hedge fund managers drooling,” in the words of the Institute on Taxation and Economic Policy.

Results 26,031 to 26,040 of 26802

Thread: Politics Thread

-

03-10-2025, 04:49 PM #26031...he went up late, and I was already up there.

-

03-10-2025, 05:42 PM #26032Junior

- Join Date

- Mar 2008

- Posts

- 2,619

And now for a dose of reality:

Total US debt = 36T

Afghan War cost = 2.3T

Iraq War = 2 to 3T

Ukraine War 0.3T

Covid response - depending on who you ask and how the numbers are calculated: 4.6T to 16T

GAO says 4.6T https://www.gao.gov/products/gao-23-106647

The USC Schaeffer Institute says up to 14T: https://schaeffer.usc.edu/research/c...-new-research/

Cutler and Larry Summers study says: 16T: https://pmc.ncbi.nlm.nih.gov/article...nited%20States.

This says 11T: https://www.covidmoneytracker.org/

Yes, all three wars were MAJOR mistakes - but can the libs please now admit so was the Covid response!!When they say, “We must protect our democracy,” switch the word “democracy” to “bureaucracy”, and it will all make sense.

-

03-10-2025, 06:00 PM #26033Junior

- Join Date

- Mar 2008

- Posts

- 2,619

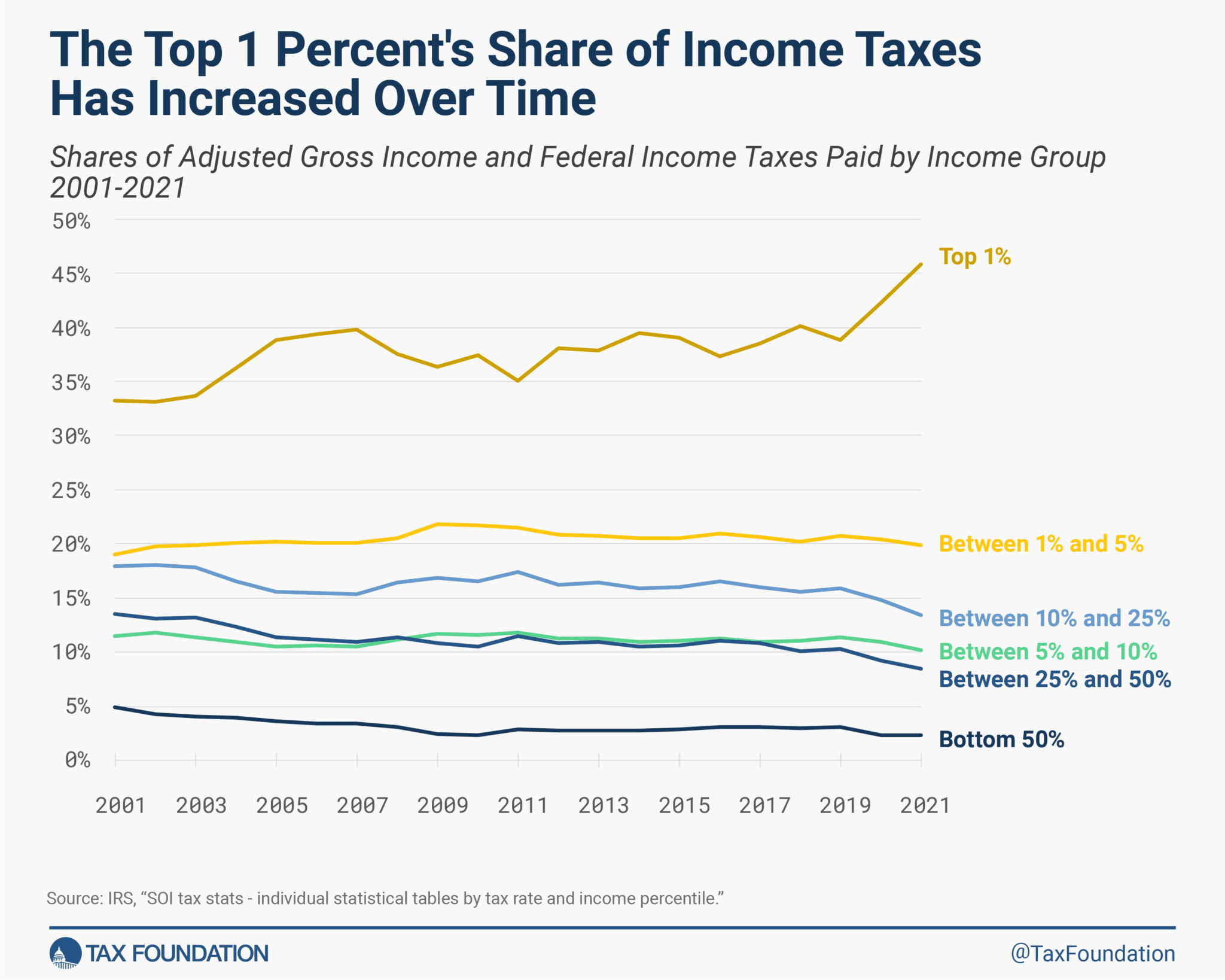

Paul said he wants to go back to 2000. I'm wondering if he's willing to have the bottom 75% wage earners to begin ponying up the amount of taxes they were paying back then? Share of taxes paid by the bottom 50% has decreased from 5% to 2.3%. Share of taxes paid by wage earners between 25% and 50% has dropped from ~14% to 8.4% of all taxes collected.

Shouldn't everyone have some skin in the game?

https://taxfoundation.org/data/all/f...tax-data-2024/When they say, “We must protect our democracy,” switch the word “democracy” to “bureaucracy”, and it will all make sense.

-

03-10-2025, 06:10 PM #26034

Okay, I’m going to mark Paul down as a revenue problem vs spending? Well except for unnecessary wars.

So tax cuts and the wars are why we’re 31T in debt? But has nothing to do with other unnecessary spending? I’m starting to think democrats really don’t want to reduce fraud and waste with the bloated federal government. Except with the inefficient IRS.

-

03-10-2025, 06:22 PM #26035Junior

- Join Date

- Mar 2008

- Posts

- 2,619

To put another way, the average tax rate paid by the bottom 50% has dropped from 4.92% in 2001 to 3.11% in 2020.

Bottom 75% has dropped from 7.47% in 2001 to 5.35% in 2020.

The top 1% also dropped in that same period. Going from an avg tax rate of 27.6% to 25.99%. However, as you see in the graph above, the share of taxes paid by the top 1% has increased from ~34% to 45.8%. This appears to be mostly driven by the top 0.001% / 0.01% of wage earners. Both groups grew by about 40% in that time period.

Lots of moving parts, but there's obviously a concentration of wealth effect. But how much of that has been driven by tech, and by increased economic activity due to lower tax rates, and increased stock trading resulting from lower cap gains tax rates?

https://www.irs.gov/statistics/soi-t...and-tax-sharesWhen they say, “We must protect our democracy,” switch the word “democracy” to “bureaucracy”, and it will all make sense.

-

03-10-2025, 06:47 PM #26036Freshman

- Join Date

- Jun 2020

- Posts

- 181

-

03-10-2025, 07:08 PM #26037

This column was written a number of years ago, but I’m guessing the math relationship is still there. We can’t tax our way out of our fiscal crisis. Serious spending cuts are needed.

http://walterewilliams.com/eat-the-rich/

Sent from my iPad using TapatalkGolf is a relatively simple game, played by reasonably intelligent people, stupidly.

-

03-10-2025, 07:34 PM #26038Hall of Famer

- Join Date

- Jan 2012

- Posts

- 18,687

-

03-10-2025, 08:07 PM #26039

-

03-10-2025, 08:59 PM #26040Junior

- Join Date

- Mar 2008

- Posts

- 2,619

Reply With Quote

Reply With Quote

Bookmarks